Average credit scores by age

08/23/2022

Tags: My finances, Debt management, Borrowing

By: Kasasa

Have you reviewed your credit report lately? You should — it’s definitely a smart thing to do. More than ever, Americans are actively aware of their credit history and the impact their financial efforts are making in building their credit history.

Credit scores are a more commonly known piece of personal information than they were just a few years ago. For young adults between the ages of 18 to 34, 93% know their credit score, versus just 57% in 2017. Increasing that awareness may be a key factor in monitoring and maintaining your credit score, which often leads to improvement.

In August 2021, the average FICO® score (one credit metric calculated by a private company) was 716. This average reflects steady increases over the past several years. VantageScore® (a comparable private company) calculated the average credit score at 695, similarly tracking the rising trend.

While the average score gives a broad view of American finances and credit health, how does your credit score compare? Your credit score cultivates over time and (hopefully) improves as you age. Knowing your credit score may be important — but understanding how it can work for you is a real game-changer in today’s society.

Average credit score by generation

Grouping credit score averages by age group may provide insights about your generation's spending and borrowing habits, but it's just as likely that it is about how old your credit history is. When you turned 21, you only had a few years, if that, to start building credit. Over decades your credit history will provide a timeline of your debts and payments, so it is not surprising, that as you — and the rest of your generation — age, you will see gradual increases in your credit score.

So where do credit scores stand for each generation right now? According to recent data from Experian™, here's where American credit scores stood by the end of 2021:

-

Generation Z (adults in their early 20s): 679

-

Generation Y (millennials, up to age 40): 686

-

Generation X (through mid 50s): 705

-

Boomers (up to age 75): 740

-

Silent Generation (born before 1945): 760

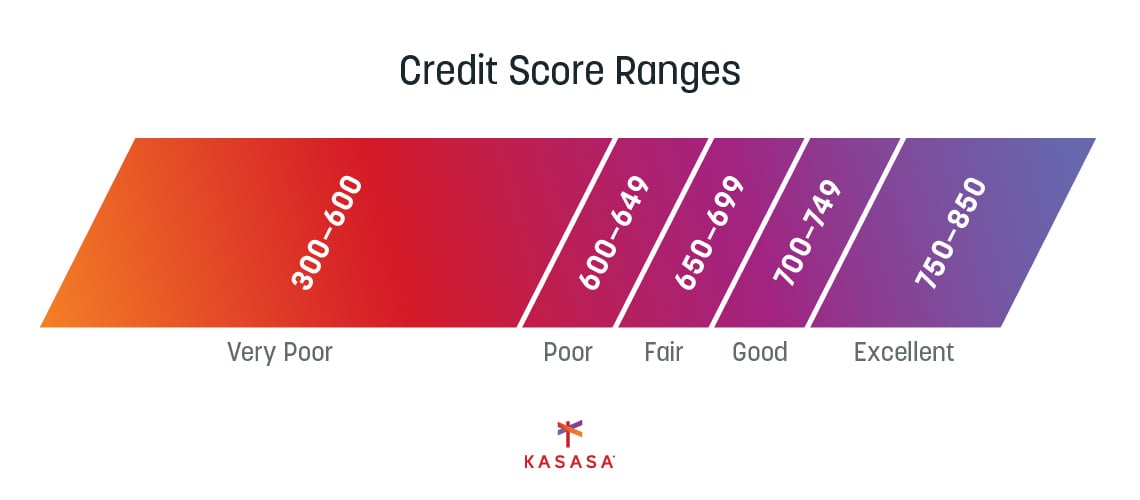

Credit score ranges

When it comes to credit score goals, we should all be aiming for “excellent” on the credit score scale. However, if you simply don’t have much history that’ll be practically impossible (in other words, don’t beat yourself up if your score is only “good” right now). Keep in mind that there are many key factors that determine credit scores and there’s just no substitute for experience. It could be that you may not have needed to borrow money yet, and that’s why you have a thin credit history. So keep your head up and understand that some factors may simply be beyond your control at this stage.

You’ll find that the three primary credit bureaus (Equifax®, Experian, and TransUnion®) can arrive at slightly different numbers. Depending on whether you are looking at a single credit bureau score or a composite, your credit scores may provide a range, rather than just a single fixed number.

Credit score factors

There are five areas that provide the bulk of your credit history information. Each one weighs differently on your overall credit health to calculate your credit score. Credit scores like FICO and VantageScore each claim their own unique "secret sauce" to calculate credit scores, but these five categories are likely always part of the mix.

Payment history (35%)

Every time you've borrowed money in the past, whether an auto loan, a credit card, a mortgage, or increasingly, even BNPL (Buy Now, Pay Later), can all be factors in your payment history. Whether those payments were on time or past due will determine how these raise or lower your credit score.

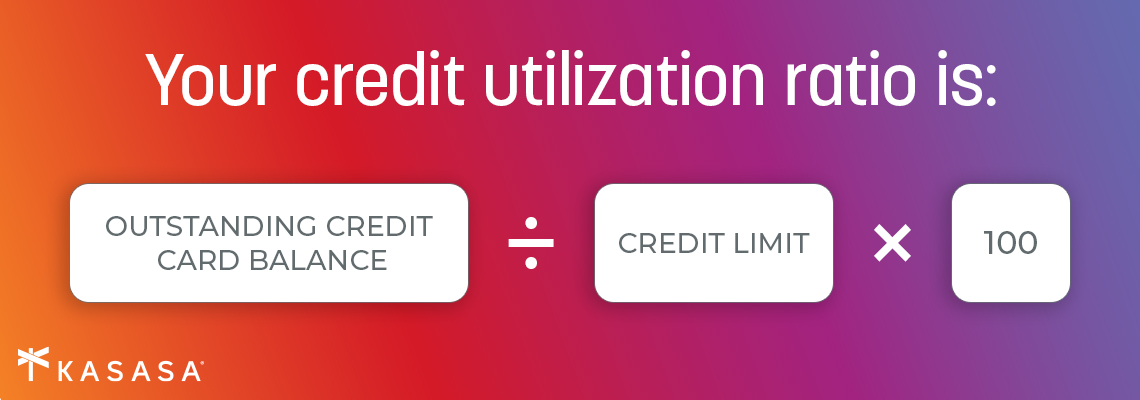

Outstanding debt (30%)

Any loan on which you are paying may fall into this bucket including outstanding student loans and your credit card balance. Credit utilization is also part of this equation (that’s how much of your available credit you are currently using) and should always be kept in mind.

Length of credit history (15%)

It's impossible to have a long credit history if you don't have a long history of earning a paycheck or just plain adulting. The above scale shows that the older a person is, the more likely it is that their credit score will be higher. That's the advantage of age, and it is part of the equation.

Account age (10%)

Credit history is also about how long you've had each type of credit. Having multiple new credit cards every few years does not equal a long credit history. One of the reasons people with mortgages have better credit scores is not just because they needed a good score to qualify, but because their home loan is a long-term loan that they typically pay for decades.

Types of credit used (10%)

While no one wants lots of debt, responsibly managing a variety of debts can also improve your credit score. Having both a credit card loan and a car payment (assuming you’re making payments on time or even paying ahead) may show that you can manage multiple debts responsibly.

You may not get to see the detailed mathematical formula that pulls all of these percentages together, but you do have the ability to monitor your credit reports from all of the three main credit bureaus and keep up with any payments to ensure you are improving the math in your favor.

Millennials saw the largest growth in credit scores

Between 2018 and 2019, millennials saw a four-point bump in their credit scores from an average of 664 to 668. While that number may not sound impressive, this increase for millennials was the largest increase across all generations.

Millennials and Gen X (the generation born just prior to millennials) are at ages where credit score improvements are common. Between the ages of 25 to 55, people are adding debt, earning more money, and paying down debt. That translates to better credit scores.

Between 2019 and 2020, millennials made even greater gains — jumping from 668 to 680. This sizable gain also moved many young adults from “fair” credit to “good” credit.

A variety of factors impacted this change but following the stimulus payments during the early months of the pandemic, 45% of Americans chose to use the money to pay down debt. This likely helped lower credit card debt, personal loan debt, and yes, student loan debt.

Given that millennial borrowers make up a significant amount of loan debt in the United States, it is not surprising that paying down debt would lead to increased credit scores for this age group. It may also come as good news that the number of Americans with “bad” credit is also on the decline.

Average credit score of homebuyers

When it comes to what credit score you need to buy a house, there are two big considerations: what credit score do you need to buy a home, and what credit score do you need to buy a home affordably? Your credit score may determine what programs you qualify for and what interest rate you lock in for your mortgage.

The credit score to obtain a traditional home mortgage is a FICO score of at least 620. Glancing at the average credit score by generation, it appears that even the average credit score for a Gen Z applicant would be enough. Even for Gen X and millennials, there is suitable credit for a traditional loan.

In 2021, however, the average credit score for home buyers was more than 100 points above the minimum required credit score of 745. Looking at those numbers again, it appears the “average” may not be enough these days. In truth, only 2% of home buyers had a credit score below 640.

Luckily, lenders consider more than just a credit score when dolling out consumer credit and new mortgages. Often, the lower the credit score, the more money is required for a down payment and another home loan type might be considered.

For example, to qualify for Federal Housing Administration (FHA) financing, a FICO score can be 500 or above, but anything in the 500 range requires the buyer to put down a 10% down payment. Given that the average home price in America is nearly $375,000, that's nearly $40,000 in savings needed to buy a house with an FHA mortgage. It's likely only older generations have access to this amount of savings.

In addition to the time it takes to build credit, the time it takes to save up for a down payment on a home makes the average credit score even more impactful. Add in the fact that many millennials prolong contributing to their savings while paying down student loan debt, it makes building a solid credit history a long journey — even with good credit.

3 Ways to improve your credit score at every age

Whether you are already entering your fourth decade or you're bumping up against the up-and-coming Gen Zer, there are a few ways you can improve your credit score.

1. Control your debt

Don't always assume debt is bad. If it is helping you buy a house or a car, it is likely necessary to help you become a homeowner or get to work. In fact, it is even to your advantage to have multiple types of credit.

The not-so-secret truth is to keep its use under control (Stay well below your credit limit) and make payments on time and in full. Whether it’s your student loan or your credit card, have a strategy for paying it down.

2. Check your credit report

34% of credit reports contain errors, so whether it's as mild as an address correction or a big red flag loan you never took out, make time to review all the credit scoring information and your personal details regularly.

If you have a low credit score because of adverse information on your credit report, it is worth your time and effort to get the errors corrected. If your credit is good, protect it and keep it that way by being vigilant.

3. Build your credit for a lifetime

As you build credit, you want to take steps that are going to support your long-term credit health. For example, choose a single credit card deliberately. Credit cards often include great introductory rates or balance transfer offers from the credit card company that sounds enticing, but one factor that improves a low credit score is increasing your length of credit history and credit age. The longer you keep a single account open, and use it wisely, the more beneficial it will be long after that introductory rate is history. Choose the best credit card for longer than just the next six months.

Consider refinancing, too, when you need to lower your payments. Whether for a home or a car (you secretly knew that dealer’s offer wasn't the greatest), refinancing a loan can cause a short-term lowering of your credit score. However, being able to pay down your loan sooner over the life of the loan can keep your payments low now and your credit score better for your future plans.

A lifetime of good credit

Just as your priorities change from your twenties to your thirties, your finances — and your credit — will change as well. Every time you check your credit score, it's a snapshot of where you are in your financial life at that moment. Make your credit history memorable and a reflection of good financial health. This way, you can proudly look back at how you handled your money now and set yourself up for success in the future.